Table of Content

However, it's still important to consider which option is right for your financial situation, especially if your poor credit is a result of missed payments. If you know that you would benefit from a structured monthly budget, a home equity loan is the right option. If you would rather focus on keeping your debt low, a HELOC will allow you to take out only as much as you need and pay it back on a more flexible timeline. Lower interest rates than those of unsecured debt such as credit cards or personal loans.

Since you use your home as collateral, if you fail to make the payments in full and on time, yourisk losing your home. Receive funds.The time between offer acceptance and funds disbursement varies by lender, but some may make HELOC funds available in as little as one week. From there, you can use your funds as needed and begin making payments. Reverse mortgage - With a reverse mortgage, you receive an advance on your home equity that you don't have to repay until you leave the home.

Diverse business resources

Your loan-to-value ratio is a percentage that indicates how much equity you have in your home. LTV is used to help determine rates for home equity loans and lines of credit. Home equity loan -A home equity loan is a second mortgage with a fixed interest rate that provides a lump sum to use for any purpose. Unlike a HELOC with an interest-only period, you’ll be responsible for both interest and principal payments when the loan closes.

While some lenders offer a wide range of loan amounts, Figure caps its loans at $400,000 — though you may qualify for less, depending on your loan-to-value ratio and credit score. There’s also an origination fee of as much as 4.99 percent. A home equity line of credit, or HELOC, is a type ofhome equity loanthat allows you to draw funds as you need them and repay the money at a variable interest rate. Because of this, HELOCs are generally best for people who need funds for ongoing home improvement projects or who need more time to pay down existing debt. HELOCs typically have lower interest rates than home equity loans and personal loans; to get the best rates, you'll have to have a high credit score, a lowdebt-to-income ratioand a lot of tappable equity in your home.

How to Apply for a Home Equity Loan or Line of Credit (HELOC)

It also includes a 0.25% initial rate discount when a borrower sets up automatic payment from an Old National checking account. If you have poor credit, you may have a harder time getting approved for a loan, but it is still possible. If you're interested inapplying for a bad-credit home equity loan, the first step is to shop around with a few lenders. Since each lender has its own requirements, it's possible one lender will be more accepting of a poorer credit score and offer better rates than a similar lender. Home equity loans and home equity lines of credit are both loans backed by the equity in your home.

Lenders may charge a variety of fees, including annual fees, application fees, cancellation fees or early closure fees. Typically lower upfront costs than with home equity loans. Lower charges a 1 percent origination fee on all HELOC transactions, so you may want to limit your spending. Lower also has a relatively low line of credit limit at $350,000. Flagstar has flexible loan amounts that range from as little as $10,000 to as much as $500,000. In that you need to qualify with a lender or bank who's willing to lend you the money.

Auto Loans

Make sure the specific terms of the loan your lender is offering makes sense for your budget. For example, be sure the minimum loan amount isn't too high and don't withdraw more funds than you need. You also want to make sure that your repayment term is long enough for you to comfortably afford the monthly payments. The shorter your loan term, the higher your monthly payments are likely to be. If you have a 30-year mortgage and are more than halfway through your loan term, refinancing into a 15-year loan with a lower rate can save you thousands in interest. While a home equity loan is a "second mortgage" that allows you to borrow additional funds for nearly any purpose, acash-out refinance replaces your existing mortgage.

Greg McBride, CFA, is Senior Vice President, Chief Financial Analyst, for Bankrate.com. He leads a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience. Andrea Riquier is a New York-based writer covering mortgages and the housing market for Forbes Advisor.

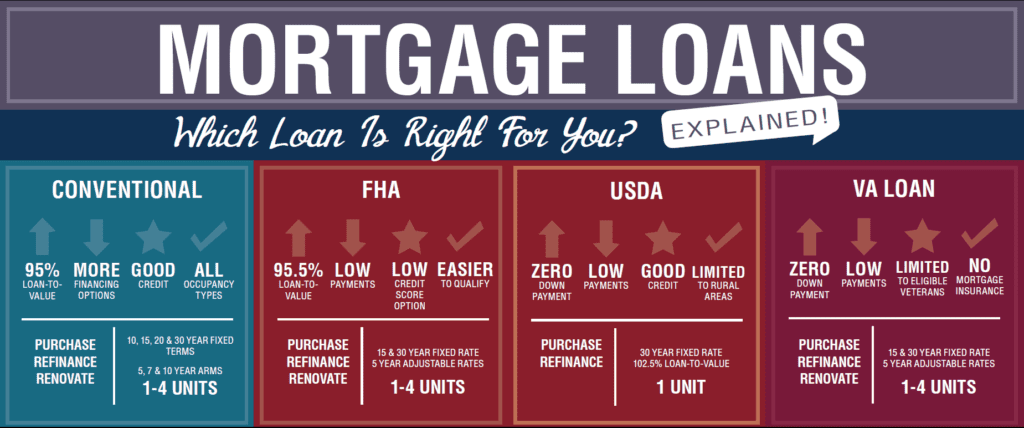

Comparing Mortgage Products

Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. For loan amounts up to $250,000, closing cost typically range between $500 and $3,000. Private mortgage insurance, homeowner’s insurance, flood insurance required. Generally during periods with low interest rates most homeowners choose fixed-rate loans.

Changes to the contract, as well as funds disbursement, cannot occur during this time. Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income. Prepare for ahome equity loan applicationby checking your credit, calculating your home equity and taking stock of how much other debt you already have. Many lenders let you start the application process online by entering your personal and financial information. The property securing your home equity loan will have to be located in a state where Regions has a branch, and you’ll need to close on the loan at a branch location.

Tuition or education costs - HELOCs often have lower interest rates than student loans, though some lenders may place restrictions on how you can use the funds. AHELOCis a variable-rate home equity product that works like acredit card— you have access to a credit line that you can draw from and pay back as needed. As theprime ratemoves up or down, so does your HELOC rate.

As of September 27, the lender had a starting rate of 6.74% for a good-quality borrower, according to a bank representative. This places Fifth Third’s rates in the middle of its peers. Loan terms range from 10 to 30 years, and there are no origination fees or closing costs.

The Federal Reserve has implemented historic rate hikes in 2022 to combat inflation, and it’s likely these increases will continue for the time being. TD Bank is a great option if you live along the East Coast and prefer to bank in person. With that said, you can also bank by phone, online or via mobile app.

In the event of a foreclosure, the lender of a second mortgage will be paid only after the lender of the first mortgage has been paid in full. To make up for this risk, lenders offering second mortgages will charge higher interest rates. Since home equity loan rates are higher than first mortgage rates as a baseline, as of early October 2022, you can expect to find home equity loan rates starting around 7 percent. When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Check the lenders’ websites to see if there is more recent information. The one-time charge of $149 that applies to newly booked home equity loans due at closing is waived, except appraisal costs or title insurance, if required.

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Home equity loans are popular among borrowers who want to use the funds to cover large expenses, such as home improvement projects or high-interest debt consolidation.

No comments:

Post a Comment